SDG Taxation Framework

Bringing greater focus on the critical role of tax policy and revenue administration in achieving SDGs by 2030

Request STF

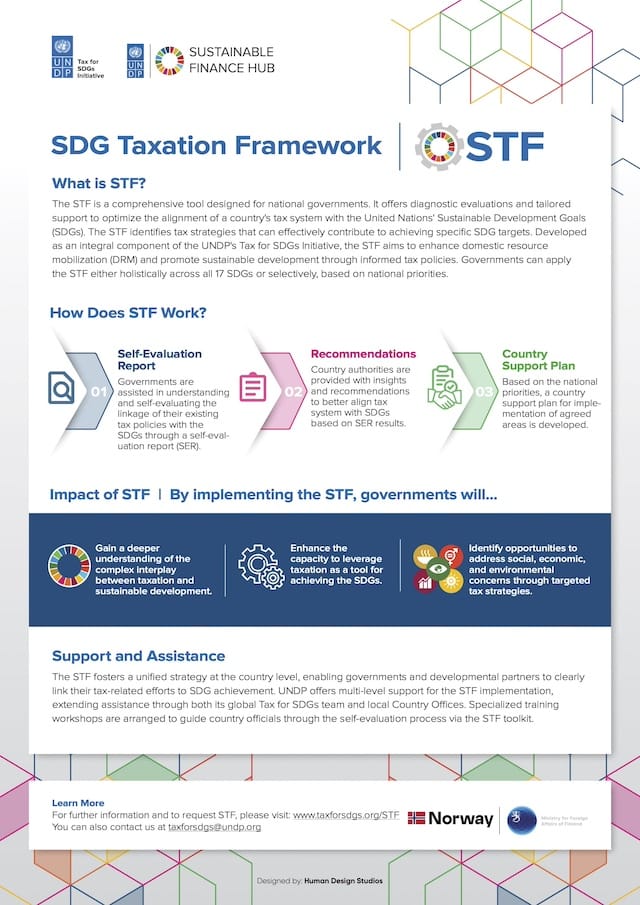

The STF is a comprehensive tool designed for national governments...

Offering diagnostic evaluations and tailored support to optimize the linkage of a country's tax system with the SDGs. The STF identifies tax strategies that can effectively contribute to achieving specific SDG targets. The SDGs outline the 'what' of development targets, while the STF explains the 'how' through a tax lens. Developed as an integral component of the UNDP's Tax for SDGs Initiative, the STF aims to enhance domestic resource mobilization (DRM) and promote sustainable development through informed tax policies.

STF Methodology

Taxation is a critical tool to accelerate SDG progress.

STF lays out a framework for leveraging taxation to influence behaviors and raise financing for SDGs.

The central focus is Domestic Resource Mobilization, Target 17.1

Governments can use it holistically across all 17 SDGs or selectively, based on their national priorities.

STF lays out a framework for leveraging taxation to influence behaviors and raise financing for SDGs.

The central focus is Domestic Resource Mobilization, Target 17.1

Governments can use it holistically across all 17 SDGs or selectively, based on their national priorities.

How It Works

Self-Evaluation Report

Governments are assisted in understanding and self-evaluating the linkage of their existing tax policies with the SDGs through a self-evaluation report (SER).

Recommendations

Country authorities are provided with insights and recommendations to better align tax system with SDGs based on SER results.

Country Support Plan

Based on the national priorities, a country support plan for implementation of agreed areas is developed.

Where we work

Resources

STF Handbook

STF Toolkit

STF Brochure (English)

STF Brochure (French)

STF Brochure (Spanish)

STF Brochure (Russian)

Get in touch if you would like to request STF support.

Please direct any STF inquiries through the TaxforSDGs contact form or by sending an email to taxforsdgs@undp.org.

We are looking forward to receiving your thoughts and feedback on the draft STF. Kindly share by February 29, 2024.

We are looking forward to receiving your thoughts and feedback on the draft STF. Kindly share by February 29, 2024.